According to information from the International Monetary Fund (IMF), Mexico regained four places in its most recent measurement (December 2023) of the 20 largest economies on the planet.

The organization projected that the value of Mexico's GDP at the end of 2023 was 1.81 trillion dollars, 400 billion dollars higher than the 1.4 trillion dollars recorded a year earlier.

Likewise, data from the World Trade Organization (WTO) reveal that Mexico is ranked 13th in imports and 12th in exports at the international level, that is, it holds a privileged global trade position with respect to the rest of the countries in the Latin American region.

However, to reach these proportions it has undergone major transformations, going from a "stabilizing period" of close to two decades, to a difficult period of recurring crises; subsequently, a stage of great internal stabilization and globalizing economic opening, to a challenging democratic period that has allowed three alternations in power without economic crisis.

Today, Mexico is a global economic and commercial power due to its size, but with great internal contrasts that the current federal administration is seeking to balance through various strategic infrastructure projects.

MEXICAN MIRACLE

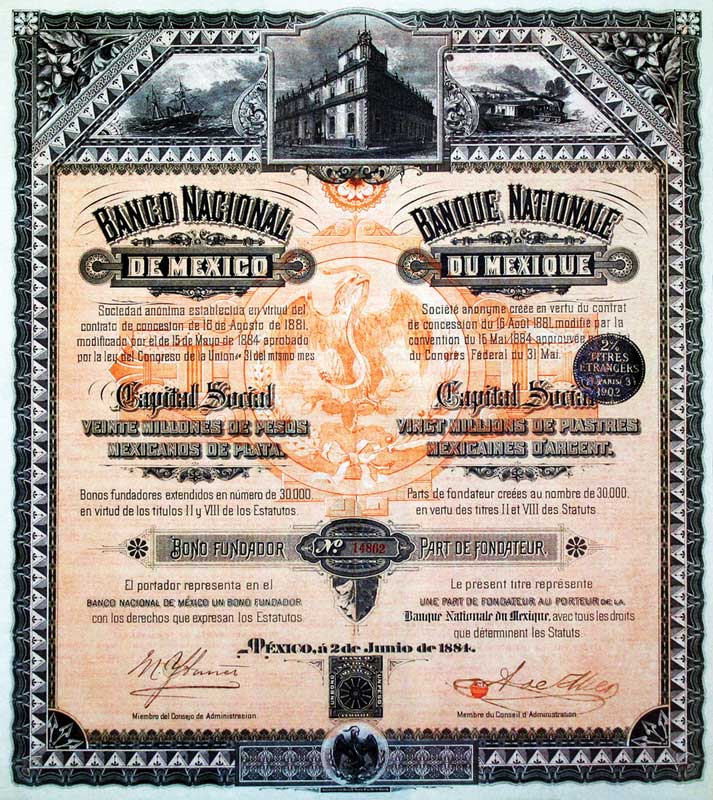

Since the mid-1950s, within the framework of the reconstruction process following World War II, the global economy was stable and dynamic. In this environment, Mexico began a process known as "stabilizing development", which consisted of prudent fiscal and monetary policies that supported a fixed exchange rate, as well as inward growth through import substitution; this policy led to a period of rapid growth with price stability.

Growth was so dynamic that it was called the "Mexican Miracle", since between 1954 and 1970, the country's Gross Domestic Product (GDP) doubled due to the high growth rate and was accompanied by exchange rate stability and low inflation rates, similar to those of developed economies.

In particular, from 1958 to 1970, the average annual GDP growth rate was 6.8 percent, while industrial production grew 8 percent and inflation 2.5 percent in the same period.

A relatively closed economy scheme was implemented in this period, through a process of consumption import substitution, along with the development of an industrial structure that at that time imported certain raw materials and intermediate components.

Part of the stabilizing development was called "import substitution industrialization model". At the same time, the government acted as a major promoter of direct investments and development poles, among which the promotion of five tourist destinations was fundamental: Cancun, Huatulco, Ixtapa, Vallarta and Manzanillo.

During the period of stabilizing development, a fixed exchange rate against the US dollar was maintained for several years, a stability that was explained by the accumulation of international reserves and the fact that inflation was very similar to that of the United States and the increase in exports (agricultural exports at that time).

In the mid 70's, due to external factors, the model showed signs of crisis, among them a rise in interest rates in the United States and a difference between inflation in both countries.

It should be recalled that in the early 1970s, in 1971 in particular, the breakdown of the Bretton Woods agreements fragmented the foundations of the post-war international monetary system. In particular, the gold-dollar standard was broken, disrupting the foundations of world exchange rate stability. On the domestic front, Mexico began to make structural adjustments to its balance of payments, which was interpreted as a sign of the exhaustion of "inward" growth. At the same time, public finances deteriorated, so that in the first half of the decade the public deficit increased, putting an end to the fiscal prudence that characterized the "stabilizing development".

Thus, the sum of high public sector deficits, a significant rise in inflation, an upward adjustment of interest rates, a sharp rise in international oil prices (Mexico was an importer), plus the imbalance in external accounts and the massive outflow of dollars, all combined to make the fixed exchange rate unsustainable and the peso had to be devalued almost 100% against the dollar in 1976, after 22 years of fixed parity at 12.50 pesos to the dollar.

RECURRENT CRISES

This was the first of several balance of payments crises that Mexico experienced thereafter, marking a period known as "Recurrent Crises". In particular, two of them occurred during the decade 1975-1985.

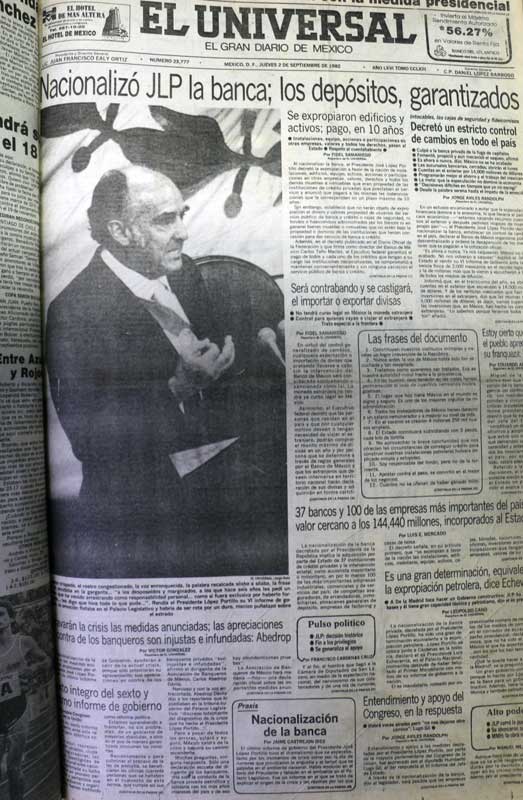

During this period, Mexico's economy became oiled, both through the export of crude oil and its public finances. We remember that at that time President José López Portillo said that abundance was going to be managed due to the discoveries of oil deposits; this oil binge led to an increase in public spending, making fiscal and monetary policy much more flexible; but this spending was never in line with income, but rather depended on an exorbitant and irresponsible public indebtedness; in addition, the economy entered into internal crisis when oil prices plummeted.

All this generated a perverse circle of higher debt, higher public deficit, higher inflation and eventually devaluation, with brutal effects on the real economy, particularly on inflation and public finances.

It was a period of great internal economic imbalance, which was reflected in devaluations, where the parity of the peso against the dollar went from 25 pesos at the beginning of 1982 to 150 pesos by the end of the year. This devaluation had a brutal impact on the real economy, inflation and public finances.

All of this affected the pace of economic growth, to the extent that in 1982 and 1983 there was a strong recession and inflation reached 100% in those years.

STABILIZATION AND STRUCTURAL CHANGE

Since the second half of the 1980s, the country's economy applied internal stabilization programs through Economic Pacts. In 1987, a political-economic agreement was signed with the objective of halting the increase in inflation (which in that year reached annual levels of 176%), interest rates, devaluation of the peso and poor economic growth.

At the beginning of the six-year term of Carlos Salinas de Gortari, the Stability and Economic Growth Pact was implemented in order to control inflationary inertia and stabilize the exchange rate. This pact was supported by a new renegotiation of the foreign debt through the Brady Plan. As a result of this plan, Mexico managed to bring inflation down to 20% in 1989.

Major structural changes in the national economy followed, such as the privatization of large state-owned companies, the deregulation of the financial system and the privatization of banks, as well as the granting of autonomy to the central bank, Banco de México. As if that were not enough, the negotiation of the Free Trade Agreement with the United States and Canada (NAFTA) was initiated.

All these major transformations in the Mexican economy drove the GDP to a new accelerated growth, observing years of 4 and 5% annual growth.

The expectation of the signing of NAFTA generated a great attractiveness of Mexico at an international level, which boosted the arrival of important flows of Foreign Direct Investment.

In spite of this, the external imbalances could not be reversed and once again there was a balance of payments crisis; in December 1994 (December error) there was another devaluation episode that eventually caused a strong recession in 1995 and a new restructuring of the banking system, because this crisis broke them and favored the arrival of foreign banks.

The peso again suffered a devaluation of around 100%, but the depreciation, in the context of a very open economy and with the institutional certainty provided by NAFTA, drove a rapid recovery of economic activity through an accelerated increase in exports.

STABLE AND EXPORT-ORIENTED ECONOMY

After the 1994-1995 crisis, the following recessionary episodes in Mexico have no longer been caused by internal factors, but by external variables. This is due to the fact that, since then, the health of public finances and great fiscal and monetary discipline have been favored.

Banco de México's total autonomy contributed to controlling inflation and the free floating of the exchange rate has avoided abrupt adjustments in the parity of the peso against the dollar since then.

With the entry into force of NAFTA in 1994, the anti-export bias of previous decades was eliminated, privileging the rules of an open economy and achieving privileged access to the North American market, mainly to the United States. Since then, Mexico's exports have multiplied.

We must remember that today Mexico has a network of 12 Free Trade Agreements with 46 countries, with a potential market of 1,479 million people, which translates into an opportunity to stimulate the search for new opportunities and better conditions for sales of agricultural, livestock and fishery products.

Although the opening of trade brought many benefits to the nation, it boosted the economy as a whole, especially the manufacturing sector, attracted much direct foreign investment, among many other things, it also widened the gap between the development of the north and the south of the country, increasing the delay in the southeast of the country.

ALTERNATION WITH STABILITY

After the great structural changes of the six-year term of Carlos Salinas de Gortari and the subsequent stability that the nation regained with Ernesto Zedillo and the continuity of trade liberalization, a democratic process of alternation in power began, where the most outstanding feature was that there were no economic crises.

Vicente Fox, from the National Action Party, won the presidency of the Republic after more than 70 years of PRI in power. However, since he did not have a majority in Congress, he avoided deepening structural reforms. The PAN administration lasted two six-year terms, with the triumph of Felipe Calderón; however, the PRI returned to power with Enrique Peña Nieto and later came the left with Andrés Manuel López Obrador.

Peña Nieto's six-year term was once called the Mexican Moment, because a second stage of structural reforms was carried out, such as energy, financial, economic competition and tax reforms, among others, in addition to the pretension of large infrastructure works; however, the imbalance that arose in public finances forced major adjustments to public spending that affected economic growth and made it very slow.

The Fox, Calderon and Lopez Obrador administrations were not exempt from recessionary crises, but each of them were caused by external factors, not by the internal problems of the past.

The last four federal administrations have been characterized by moderate growth but very stable inflation and great discipline in public finances and responsible monetary policy. In fact, these last qualities make foreign investors very confident in Mexico.

It should be noted that the administration of Andrés Manuel López Obrador has promoted large infrastructure projects, especially for the southeastern region of the country, seeking to reduce the economic and development gap with the center and north of the country.

Hence the importance of projects such as the Mayan Train, the Dos Bocas refinery and the Inter-Oceanic Corridor of the Isthmus of Tehuantepec, which represents a great opportunity for Mexico to become the navel of the world's logistics.

Text:Jesús Arias

Photo: HEMEROTECA NACIONAL DE MÉXICO / CENTRO CIEN / afp / (TLCAN).JAWED GFX